Seamlessly Accept Payments In A Way You and Your Clients Will Love

As a small business owner, few things are as frustrating as chasing overdue invoices. Not only does it disrupt your cash flow, but it also takes time away from growing your business or serving your clients. Fortunately, with the right tools and strategies, you can make getting paid simple—and enjoyable for both you and your clients.

Let’s face it: online payments are the professional standard. Asking clients to pay through personal apps like Venmo or Zelle, or waiting for mailed checks and in-person cash, doesn’t just slow you down—it diminishes the client experience. Dubsado gives you a streamlined, secure, and professional way to reliably accept payments, enhancing your brand’s credibility, with flexible options your clients will love.

Whether you’re looking for the best invoicing software for small businesses or ways to simplify payment processing, Dubsado has you covered.

Here’s how Dubsado can transform how you handle client payments, making it easy, professional, and client-friendly.

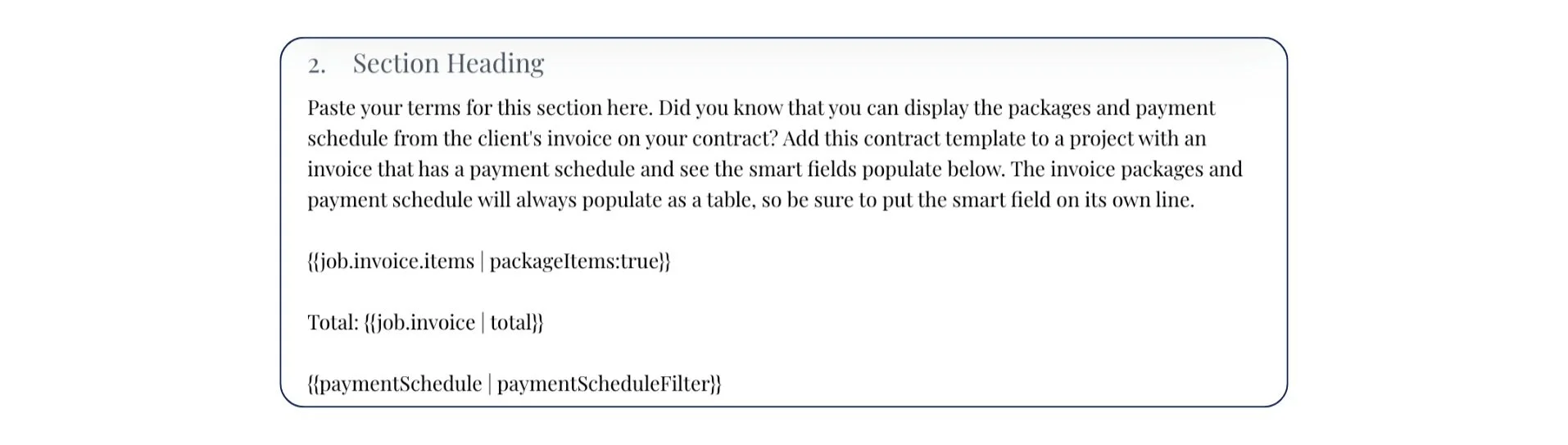

1. First, set clear contract clauses to set expectations

A strong contract is your first line of defense against overdue invoices. With Dubsado, you can easily include contract clauses that outline payment deadlines, late fees, and autopay requirements. These terms set clear expectations from the beginning and give you a legal safety net in case of disputes.

Pro Tip: Use Dubsado’s customizable e-signature contracts to save time while ensuring every client agreement is airtight and smart fields to autofill important client details.

2. Direct online invoice links for easy payments

Make getting paid simple for everyone involved. Dubsado’s direct online invoice links remove unnecessary barriers, allowing clients to pay instantly with just one click—no logins, no codes, no extra steps.

Have a client whose invoice is being paid by someone else? No problem. They can simply forward the invoice email, and the third party can access the link and complete the payment directly.

Plus, clients can always access invoices and payment links anytime through their centralized client portal, alongside all other project communications and documents—keeping everything organized in one place for a seamless experience.

Want to speed up checkout even more? With Link, clients can securely save their payment details for future use, making checkout up to 9x faster and reducing abandoned invoices.

Need faster access to your money? With Instant Payouts, you can receive your funds within minutes instead of waiting for standard processing times—giving you more control over your cash flow.

Worried about transaction fees? The benefits far outweigh the cost—plus, with Dubsado’s surcharging feature, you can even offset those fees, or where applicable, you can accept ACH payments for an even lower fee. Not to mention, transaction fees are tax-deductible, making online payments a smart investment that saves time, reduces risk, and delivers a better experience for both you and your clients.

Here’s what one happy customer shared about Dubsado’s invoicing tools:

"Switching to Dubsado for invoicing was a game-changer. I’ve saved hours every week by automating my payment process, and my clients love how easy it is to pay online. It’s the best decision I’ve made for my business!"

3. Accept in-person contactless payments

Whether you’re booking a new client at an in-person consultation, accepting payments at an event, or closing out a service, Tap to Pay lets clients pay instantly using their mobile wallet, Apple Watch or contactless card—no additional hardware required.

This frictionless payment experience not only eliminates follow-up reminders but also offers a seamless checkout your clients will appreciate. Because when paying is this easy, you get paid faster, and clients leave with a positive impression of your business.

4. Flexible Buy Now, Pay Later options with Affirm and Klarna

Offering flexible payment options doesn’t just boost client satisfaction—it gives you a competitive edge. While others may limit clients to upfront payments, you can stand out by offering Buy Now, Pay Later (BNPL) options through Dubsado’s integrations with Affirm and Klarna.

This flexibility makes your services more accessible to a broader audience by allowing clients to split payments over time—without putting a strain on your cash flow. Plus, BNPL can encourage clients to opt for larger packages or add premium add-ons they might not have considered otherwise.

Even better? These BNPL options help eliminate the risk of late or non-payment, as providers like Affirm and Klarna assume the payment risk. You get paid upfront, while your clients enjoy the freedom of manageable installments.

Worried about transaction fees? The benefits far outweigh the cost—from increasing your average transaction value to expanding your client base and securing guaranteed payments, it’s an investment in steady growth and client satisfaction.

With Dubsado’s BNPL integrations, you’re not just getting paid—you’re unlocking new growth opportunities and delivering a payment experience your clients will love.

5. Automated payment reminders

No more awkward payment follow-ups or forgetting about late invoices. Dubsado lets you set up automated reminders that notify clients about upcoming or overdue payments.

Example:

“Your payment is due tomorrow—click here to pay.”

“Your invoice is now overdue—complete payment to avoid late fees or service disruption.”

These gentle nudges ensure clients stay on track, minimizing delays and reducing the mental load of managing overdue invoices. And the best part? These won’t send if the client pays before the reminder is sent.

6. Autopay for payment plans

Accepting payment installments is a breeze with Dubsado’s autopay feature. By requiring autopay for payment plan installments and recurring invoices, you eliminate the risk of clients forgetting to pay or delaying their installments.

Plus, clients can easily update their payment method at any time without interrupting autopay, ensuring payments continue without disruption.

This automated option ensures your revenue stream stays consistent, allowing you to focus on what matters most—growing your business.

Why small business owners choose Dubsado

Dubsado goes beyond invoicing to provide a solution for managing your business in one place. From customizable contracts, forms, appointment schedulers, and workflows to integrated payment processors like Stripe, PayPal, and Square, it’s designed to save you time and help you run your business more efficiently.

Need faster access to your money? With Instant Payouts, you can receive your funds within minutes, giving you more control over your cash flow. No waiting for standard processing times—just fast, reliable access to your earnings.

Ready to transform your invoicing system?

Start your free trial for up to 3 clients with Dubsado today and experience how easy it can be to accept payments both you and your clients will love.

FAQ

Q: Can I customize my invoices in Dubsado?

A: Yes! Dubsado allows you to add your logo and invoice terms to match your brand, giving clients a professional experience.

Q: Are clients credit cards saved in Dubsado?

A: Client credit card information does not get stored in Dubsado since all transactions are handled securely by your payment processor (Stripe, Square, or PayPal). For payment security, Dubsado never comes into contact with your client's payment information or funds!

Q: What payment processors integrate with Dubsado?

A: Dubsado integrates with popular payment processors like Stripe, PayPal, and Square. These options make it easy to accept payments from clients securely and efficiently. Although, some of the tools above are exclusive to Dubsado Payments powered by Stripe.

Q: What are Dubsado’s transaction fees?

A: Transaction fees depend on the payment method used (credit card, ACH, etc.) and location; you can view the full breakdown here.

Q: Does Dubsado support international payments?

A: Absolutely. With integrations like Stripe, Square, and PayPal, you can accept payments globally.

Q: Can Dubsado help with payment plans for clients?

A: Yes! Dubsado’s payment plan feature allows you to set up recurring invoices with automated due date reminders. You can even require autopay to ensure clients never miss a payment.

Q: How do automated payment reminders work in Dubsado?

A: Once you set up a payment plan or invoice, you can schedule custom reminders to be sent automatically via email on the dates you choose with your brand messaging front and center. These reminders notify clients of upcoming payments or overdue balances, saving you time and reducing awkward follow-ups.

Q: Can I use Dubsado to create recurring invoices?

A: Absolutely! With Dubsado, you can set up recurring invoices for subscription-based services or payment plans. Clients can be automatically charged on the schedule you set, simplifying your billing process.